2013 Predictions and Market Rebound

Last year, the housing market rebounded sharply as inventory remained low, investor activity remained high, and low interest rates spurred an early-year rally that reflated much of the air back into the old housing bubble. Why do I insist on portraying the strong market action as reflating the housing bubble? Three reasons: manipulated inventory, weak owner-occupant demand, and fabricated mortgage interest rates. First, inventory was artificially low due to bank policies regarding loan modifications, short sales, foreclosures, and squatting. Houses that ordinarily would have been on the market were not. These houses will hit the market in the future. Second, demand from owner-occupants — typically the drivers of housing market expansion — grew very little, calling the entire recovery into question. And third, mortgage interest rates hit record lows in the Spring of 2013, but when rates rose suddenly, the house price rally abruptly stopped, which is where we are today, waiting for a spring rally that may or may not materialize.

It’s the start of a new year, time to look ahead, dust off your crystal ball, and gaze into the unknown. What will happen to the housing market in 2014? Before I start, I want to make some general observations on predictions. Most economists who bother to make predictions offer vague predictions that allow them to claim clairvoyance even when they completely blow it. Further, some of these economists rewrite history to claim they predicted something they didn’t with hopes that nobody calls them on it. Another tendency among these economists is to make predictions with low thresholds for success that may or may not have a causal relationship to the outcome. For example, if I predict house prices will rise in 2014 because employment will improve, have I really predicted anything? We are coming out of a recession, so employment is bound to improve a little, thus the low threshold for success, and the new jobs may be low paying which doesn’t contribute to housing demand, but if house prices go up, I look correct even when I wasn’t.

The predictions I make this year will be bolder. They will contain a higher threshold for success, and they will be counter to the conventional wisdom. I could easily be wrong, but I won’t be timid. Here goes.

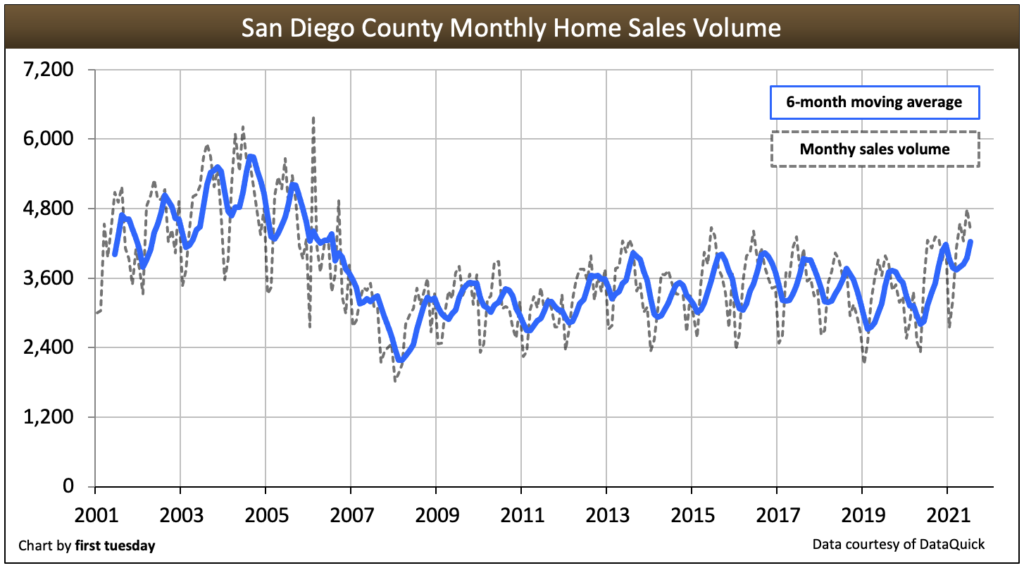

Sales volumes will decline from 2013 levels

Most economists predict home sales and prices will rise in 2014. The consensus retreats to safe predictions with a high probability of success, particularly given the momentum from 2013. I believe the consensus will be wrong, and sales volumes will decline, house prices may rise, but sales volumes in 2014 will be lower than 2013. The biggest demand cohort in 2013 was investors, many paying all-cash. With house prices 20% higher or more, these investors will not be nearly as active in 2014. In fact, I predict one of the big housing stories of 2014 will be just how dramatically and abruptly these investors pull back. For sales volumes to increase from 2013 levels, owner-occupants must make up the difference. With a continued tightening of loan standards and a relatively weak economic recovery, I don’t see that happening.

Sales will be particularly hard hit in the Bay Area and the Inland Empire

The sleeper story of 2013 was the surprise move by the FHA to lower the conforming limit in most areas across the country. In those areas where FHA loans were most popular, sales volumes will decline most precipitously. The Bay Area, more so than Southern California, relied on FHA financing up to $729,750. The Bay Area has more households with incomes to support that much debt even with the higher costs. The Inland Empire will endure a brutal decline in sales volumes, with the homebuilders particularly hard hit as somewhere between 25% and 50% of their buyer pool just evaporated.

Boomerang Buyers Will Not Materialize

The wishful thinking meme of 2014 will revolve around boomerang buyers. Everyone realizes owner occupants must fill the void left by investors. Most forecasters believe this will come from the newly employed and boomerang buyers who restore their credit ratings. These buyers will not materialize as hoped. Historically only about a third of those who lost their homes ever own again. Even if they want to buy — and many don’t — they won’t have the credit score or the down payment necessary to fulfill their desires. Further, many of the newly employed won’t have the down payments, and when they see how high house prices have become, they will feel little urgency to buy, particularly in areas where owning costs more than renting, which is becoming the norm again in many markets. The failure of these buyers to materialize with be the biggest surprise and disappointment of 2014 — and it will only be a surprise to those who believe their own wishful thinking.

Delinquency Rates Will Remain Stubbornly High

Delinquency rates declined somewhat in 2013, mostly by loan modifications. In 2014 many loan modifications from 2009 through 2011 will reset to higher interest rates and higher payments. The delinquency rates on these loans is already appalling, and they will deteriorate. The sky-high redefault rates on loan modifications will cause overall delinquency rates to fall far less than expected. They may even go up on a year-over-year basis. Delinquency rates at the end of 2014 will be higher than 5.5%, more than 4 times normal.

Foreclosure Processing Will Increase From 2013 Levels

The conventional wisdom states the foreclosure problem is behind us. Forecasters nearly universally agree foreclosure processing will decline because borrowers are going back to work and catching up on their mortgage payments. I believe they will be proven wrong. First, almost nobody cures once they go 90 days delinquent. Most borrowers end their misery by selling, lately by equity sale, but also by short sale or foreclosure. Since most market forecasters erroneously believe these borrowers cure their loans when they regain employment, these forecasters will be surprised when the high delinquency rates prompt lenders to begin foreclosure processing.

Loan Modification Redefaults Will Cause Foreclosures

When loans first go bad, lenders loathe to process foreclosures because they must recognize a loss; however, once a loan modification defaults, the lender is less motivated to kick the can. First, house prices are higher now, so kicking the can with another loan modification may not be a big benefit to the lender, particularly if the borrower is near equity. Second, any loan modification done through HAMP was removed from the lender’s books and transferred to a new MBS pool likely purchased by the federal reserve. Did you realize the federal reserve was buying all the toxic loan mod pools? Nobody else would pay top dollar for that trash. Since the federal reserve printed the money, they could care less about recognizing losses. The federal reserve will instruct the servicers to process the foreclosure and recycle the property.

Down Payments of Less Than 20% Make a Comeback

Potential buyers simply don’t have 20% to put down on a property. Given the state of the economy over the last five years, few people were financially secure enough to save 20% for a down payment on an inflated house price. With the FHA and GSEs continually pulling back, private money will step into the void, and the only way to grow that business is to offer borrowers alternatives to putting 20% down. I believe we will see more 90% loans, and later, we will see more piggy-backs, many with 10%+ interest rates. The return of private capital will be slow, and the price will be high, but it will happen. If it doesn’t sales volumes will take an even bigger hit than I’m predicting.

Where the Consensus is Right

The consensus opinion will get a few items correct. Mortgage interest rates will rise above 5% in 2014. Everyone believes this will happen, and they are likely correct. With low loan demand and plenty of money to loan out, lenders will be motivated, so mortgage interest rates may not rise too high unless macro circumstances get out of control and the federal reserve losses control of the yield curve — not likely, in my opinion.

Lending standards will tighten in early 2014 as lenders comply with Dodd-Frank, but they will loosen as the year progresses. Spring of 2014 will mark the tightest standards for the cycle. Lenders want to make loans, and if they don’t loosen standards, they won’t make any. The drive to do more business will prompt lenders to relax standards and take on more risk.

2014 Housing Pricing Prediction

I believe house prices will rise in 2014 despite the drop off in sales volumes. Because so many potential sellers are trapped in cloud inventory, they can’t lower their prices, so realistically, house prices can only go up; however, since prices are pushing against the ceiling of affordability, and since all-cash buyers still make up 50% of the market, I believe these all-cash buyers will push prices up once again. As prices go higher, both all-cash buyers and financed buyers will become more scarce, which is why I believe sales volumes will decline. The price rally will continue, inflating a mini-bubble, but the weak sales volumes portend a rocky future. If the all-cash buyers don’t materialize, prices may remain flat, but the lack of demand won’t help sales volumes.

Less Favorable 2014 Outlook

As both prices and interest rates continue to rise, I expect my monthly housing market reports to view the market less favorably. Right now, the market is fairly valued — it’s as good a time as one can expect when the cost of owning is compared to renting. If house prices remain flat or drift up only slightly, my market reports will remain sanguine; however, if prices and interest rates keep rising — and they probably will — my reports will turn bearish, and owner-occupants will be priced out of the market — for a while.